Self Directed IRA for Real Estate: Benefits, Risks, and Next Steps

Precious metals are becoming more popular investment https://larrydental.com/2023/06/11/best-silver-ira-companies-gets-a-redesign/ choices because they can act as a hedge against economic volatility and inflation. The consequences for violations of IRA rules are harsh and include being subject to taxes and penalties. This Austin based firm offers a highly secure storage facility, free phone consultations, and a wealth of free educational information. It will be your bet against the IRS, not theirs. Former Federal Reserve Chairman of 18 years Alan Greenspan recently wrote that to contain inflation, interest rates would need to be raised to double digits in the next couple of years. The company has a team of experienced professionals that provide excellent customer service and guidance on silver IRA investments. Unfortunately, doing a silver IRA rollover is much more than just transferring funds from one account to the other.

About Brand Spotlight

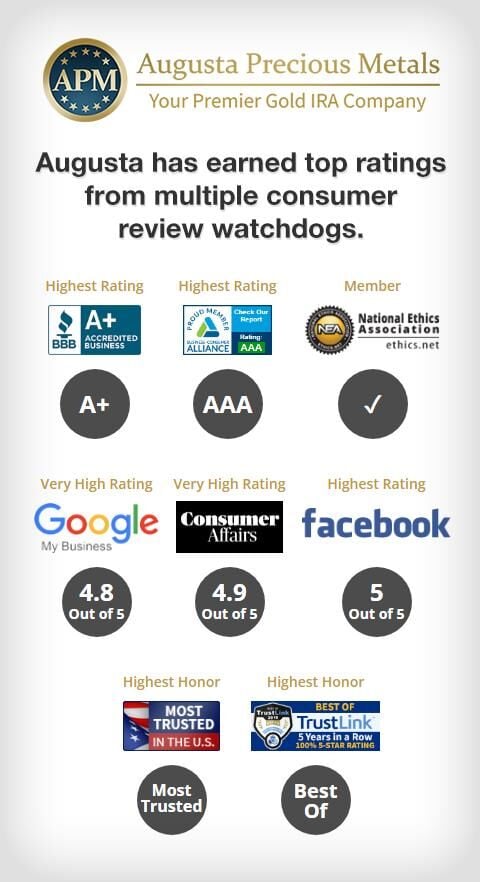

Titan is an investment platform with a team of experts actively managing your portfolio based on your chosen strategy, including cryptocurrencies. In fact, there are only certain gold, silver, platinum and palladium products that are eligible for inclusion within an IRA account. Note: The CARES Act suspended RMDs for 2020. We want to ensure that our clients have the best investing experience possible. Provided they meet minimum fineness requirements1, these metals can be held in a retirement account. For the best overall Gold IRA company go with Augusta Precious Metals if you have $50,000 or more to invest. Some dealers and companies demand a greater fee for gold IRA transitions because they need a lot of paperwork. Get the Most Out of Your Silver with Noble Gold. They have been in business for over 20 years and have earned a loyal following of customers. Silver coins and bars: They must have a 0. In turbulent times, having retirement savings is good, but having a portion of invested with the ultimate inflation and economic hedge precious metals is even better. This is because when inflation occurs, gold typically appreciates.

11 GoldBroker : Best for International Investors

Founded way back in 2003, Birch Gold still maintains a stellar reputation. Again, you should consult with your CPA about this option. Meanwhile, the annual storage fee with the Delaware Depository starts at $100 and goes up $1 per every additional $1,000. Numerous economists are predicting the next economic correction or crash could be just around the corner. It is also one of the only silver IRA companies that work with a third party compliance team and of which an experienced lawyer is also a member, which instills more trust in their IRA process. Therefore, customers will have to pay if they want to open an account. They won’t focus on the complicated reporting and file keeping that is required in order to have a reasonable chance of defending the scheme against an IRS attack.

Deciding on a Gold IRA Rollover Strategy

It is also important to look for companies that offer a wide range of gold IRA accounts, such as self directed, traditional, and Roth IRA accounts. Their main goal is to help new gold IRA investors make an informed decision about your retirement options. These sources should provide detailed and unbiased reviews of the different brokers and custodians. Divergences in Ratios Show Silver Is Undervalued. Here are the fees you can expect. A gold IRA is a retirement account that holds physical gold, allowing individuals to diversify their retirement savings and protect their wealth. 8 rating on Trustpilot. Customers have highly regarded Goldco for their comprehensive customer service, swift and easy processing, and assistance with all of the paperwork.

Gold Bars

Goldco offers both gold and silver IRAs, but no other precious metals in IRA format. The company often has promotions such as waiving fees or providing free insured shipping for a year. The primary objective of virtually all Gold IRA investors is long term preservation of wealth – and a precious metals IRA is a safe, stable, and powerful vehicle for maintaining long term asset growth. Remember that timing is very important as you withdraw from this market since at the end of the day, your most important goal is to make your investment worth your while. Feel free to give us a call at 1 800 526 7765 or email with your questions. Regency Mint is our silver supplier because they do what they say they’ll do. Banks, credit unions, brokerage firms, and other organizations that have been granted federal approval to offer custody services to gold IRA holders are known as custodians.

About Us

Nowadays, it’s one of the best silver IRA companies out there and has received thousands of positive reviews over the years due to its convenient offers for clients and top notch customer service. Minority Mindset, LLC is an independent, advertising supported publisher. Physical gold and silver is the unshakable asset, as it is outside any national economic system. 5638 Mission Center Road 104 San Diego, CA 92108 619 342 8090 M F 10 5 vault access till 6Sat 10 3 vault access till 4. Their expertise and commitment to customer service is unparalleled, providing a secure and reliable gold IRA platform for customers. Advertiser: Paradise Media. Download Our IRA Brochure. The Silver American Bald Eagle is struck by the Perth Mint from 2 oz. Gold stored in gold IRAs come in two forms, these are bullion and coins.

Birch Gold: Rating Gold IRA Rollover

Below, is some information to help explain what you need to do. Provided applicable regulations are followed properly, the transfer should be completed without issue, and the balances in the relevant accounts should be equivalent or zero upon conclusion. With a commitment to excellence, Augusta Precious Metals provides clients with the highest quality of service and expertise. The IRS, says the WSJ, “warns taxpayers to be wary of anyone claiming that precious metals held in your IRA can be stored at home or in a safe deposit box. We at IRA Innovations make no investment decisions or give investment advice. The custodian will provide guidance and assistance in selecting the gold and other metals, as well as providing information on pricing and availability. Investing in precious metals is a smart move for anyone who wants to protect their retirement savings from inflation. If it happens to you right before retirement as it did to many during the Great Recession, you could be forced to continue working. Their customer service is top notch and they offer a variety of customer support options.

Great Tax Advantages

These contracts bind the state to repay you plus interest after a specific time, regardless of what happens. Another important factor to consider when selecting a broker or custodian is their customer service. Discover the Benefits of Investing in American Hartford Gold Today. Their customer service level is second to none. Items 1 25 of 27 Total. American Hartford Gold Group, on the other hand, has a team of in house gold and silver specialists who provide investors with personalized advice and assistance. A self directed IRA offers investors more options than those available through traditional custodians. See the full list of IRA approved silver coins.

Gold IRA Distributions

When investing in a Silver IRA, you can purchase silver coins or bars as often as you’d like. ” ‘Because gold prices generally move in the opposite direction of paper assets, adding a gold IRA to a retirement portfolio provides an insurance policy against inflation. Wells Fargo has more complaints than most would like to see, according to data registered with the Consumer Financial Protection Bureau CFPB. In the following paragraphs, you’ll learn about the types of silver coins and bars allowed in an IRA, IRS requirements for silver held in an IRA, and information about popular silver bullion coins that are NOT IRA eligible. They should trust those. This firm will act as your liaison when buying or selling your precious metals to ensure you get value for your investment. Birch Gold Group usually works with clients to help them understand where their money is invested and why this is the best investment option.

Make a Payment

Join our mailing list to receive updates. People need at least $50,000 ready to invest if they want to qualify for an account with Augusta Precious Metals. When selecting a gold IRA provider, it’s important to look at several factors such as pricing structure and fees associated with investing in precious metals through them. This company has risen to the top because of its commitment to making the investment process simple and transparent. Join the Gold Alliance and Unlock Your Full Potential Today. Speak to your financial advisor. 3 Best Customer Service: American Hartford Gold.

COMPANY

Once submitted to your new custodian, your account will typically be set up within 48 hours. With the Oxford Gold Group, customers can rest assured that their investments are safe and secure. The process of a Silver IRA rollover is easy with the guidance of the specialists at Goldco. Like a lot of excellent precious metals IRA companies out there, Birch Gold assures full transparency over their fees. It is very important to do your own analysis before making any investment based on your own personal circumstances and consult with your own investment, financial, tax and legal advisers. Secure Your Financial Future With American Hartford Gold Group. You’ll need a Self Directed IRA Provider, Dealer, and Depository. This can streamline the process of setting up your silver IRA, as the dealer can coordinate directly with the chosen depository to ensure seamless transfers, storage, and management of your assets.

Actions

Their expert staff, competitive pricing, and commitment to excellent customer service make them an ideal choice for investors looking to protect their wealth with precious metals. Mint and Royal Canadian Mint. Aside from US customers, the company serves investors in Germany, London, Hong Kong, and Sweden. Gold retirement accounts were introduced in the investment market starting in the late 1990s. The best gold IRA companies know all the IRS rules for retirement accounts, so they give you the help you need to set up the best portfolio possible in compliance with related regulations. Gold individual retirement accounts IRA are one method of investing in these precious metals. Once you decide to sell all or a portion of your metals you can contact us.

Commission and Fees 2

Be sure to confirm your rights before investing. Investors can fund their gold IRAs by contributing to it within the annual contribution limits: $6,000 for those younger than 50 and $7,000 for those 50 or older. The best silver IRA companies offer buyback programs. You can read our affiliate disclosure in our privacy policy. Best for Diverse Storage OptionsStar rating: 4. Make sure they are licensed and insured, and that they offer competitive fees and commissions. Gold and silver IRA investments are becoming increasingly popular as a way to diversify and protect one’s retirement savings. When it comes to investing in a gold IRA, there are several important things to consider. When looking for the best gold IRA companies, there are a few key factors to consider.

GOLD PRODUCTS

Many clients prefer the savings in both time and money available when they Buy from Money Metals Exchange and Store with Money Metals Depository. By Ahad Waseem Paradise Media. Silver American Eagle coins. Bars are identified by size/weight and refinery for example, a 100 oz. You want to make sure that the company is capable of negotiating the purchase of your gold within a reasonable time and then have it delivered to your vault on time. It’s a telltale sign that they want to siphon off more money from you since they know you can afford to invest such an amount. Reviews have pointed out that the staff at American Hartford Gold are quite attentive and professional. Have questions about rental property loans or hard money loans. > Get a Free Web Conference With Their Economist.

Resources

Some agents will try to push you to invest in collectibles and numismatic precious metal coins simply because these will yield much higher profits for them. For publicly accessiblesystems: i the system use information is available and when appropriate, is displayed before grantingaccess; ii any references to monitoring, recording, or auditing are in keeping with privacyaccommodations for such systems that generally prohibit those activities; and iii the notice given topublic users of the information system includes a description of the authorized uses of the system. By entering your information and clicking Get Started, you consent to receive reoccurring automated marketing text messages and emails about Equity Trust’s products and services. He is always our 1st choice, if we need loan help. The company offers competitive rates and a wide range of options to help customers build a secure retirement portfolio. Copyright © 2023 Digital Financing Task Force Advertising Disclosure Privacy Policy. They may also work with trustworthy custodians. This allows customers to conduct transactions with American Hartford Gold from anywhere.

Lear Capital

Clients shouldn’t feel bad for changing their minds. As for Donna, her physical possession of IRA assets as the IRA’s owner resulted in a taxable distribution, irrespective of her status as Green Hill LLC’s manager or Green Hill LLC’s ownership of the assets. Red Rock Secured also offers competitive pricing and flexible investment options. Discover the Benefits of Investing with American Hartford Gold Group Today. With the help of one of the best gold IRA companies, you can ensure the process is completed correctly and efficiently. Discover the Gold Standard in Quality with GoldCo. A gold self directed individual retirement account IRA, or precious metals IRA, is an IRA that includes IRS approved precious metals, including gold, silver, platinum, and palladium. You can often find reviews and ratings from other borrowers online, which can give you a better idea of a lender’s reputation. Based on our research, we believe that you’re in good hands with any of the above gold IRA dealers. Founded in 2016, Noble Gold is a welcome addition to the gold IRA market, especially for small investors. It’s important to note that rare coins are not allowed in IRAs.

The Simple Strategy of Investments in a Gold IRA

Clear communication with a company is key to making informed decisions. And it’s not illegal for companies to charge for services you could do for free. Once your Precious Metals IRA is funded, you can choose which precious metals you’d like to have as a part of it. Get Free Gold Investment Kit From Augusta Precious Metals Our 1 Choice for Gold IRA Company. We earn a commission if you make a purchase, at no additional cost to you. Hunter Health Silver+ Cover 8, $226 per month. The Rollover IRA allows users to move money from an old employer sponsored retirement plan into an individual retirement account. Silver currently trades at low levels due to its massive supply. This gorgeous coin features Ian Rank Broadley’s famous effigy of Queen Elizabeth II on the obverse, while the reverse features an image of the Washington Monument. He teaches savers what’s going on in our economy. Goldco is a company that specializes in helping people convert their retirement savings into physical silver IRAs. It’s important to weigh the pros and cons of any gold IRA provider, and Birch Gold has low minimum investments and a wealth of experience. The company also assists in the storage and transportation of precious metals on your behalf. 95 stars from customers and is endorsed by Mark Levin, Judge Jeanine Pirro, and Joe Montana.

Reseñas

You’ll most likely have to deal with three different types of fees if you make gold IRA investments. In this guide, we will look at some of the top precious metals IRA companies in the industry. Here are some of the factors we considered when narrowing down our list. Rosland Capital cannot guarantee that the information herein is accurate, complete, current or timely. Trading on margin increases the financial risks. 1Eligible bullion includes U. These deposits must follow the annual IRA contribution limits.