Gold, Silver, Platinum, and Palladium Trading

Investing in gold is a popular choice for retirement accounts, and many people choose to add gold to their IRA. HCF Silver Plus, $221 per month. Some companies, like Augusta Precious Metals and Birch Gold, specialize in helping investors create a diversified portfolio that includes both gold and other precious metals. Date of experience: May 26, 2023. The process of setting up a gold IRA with Noble Gold Investments is fairly straightforward. Hedge Against Inflation.

How to Convert Roth IRAs Into Real Estate

00 in your account at all times. Many investors fund a gold IRA with funds from a 401k or traditional IRA. As one expert frames it; “you can own a bakery with your IRA, but you cannot be the baker. His low key style and professional demeanor are valuable traits to have in dealing with customers. Think strategically and consult a financial advisor to make the most of your investment. Your personal advisor will help you with each step of the process of securing your retirement savings with gold, silver, platinum, and palladium products. Overall, investing in a gold silver IRA can provide diversification and a hedge against inflation, making it an attractive option for retirement planning. New Direction allows clients to use a variety of depositories giving customers more choices than many other trustees do and still has highly competitive fees starting at only $75/year. We Sell Call for Pricing. We are large enough to provide the advantages of scale, but not so large that we do not have time for you. Today, it continues to build upon that legacy, providing up to date news, educational resources, and tools that help people create meaningful investments and lasting returns. Your email has been sent.

Get Our Rare Coin Guide

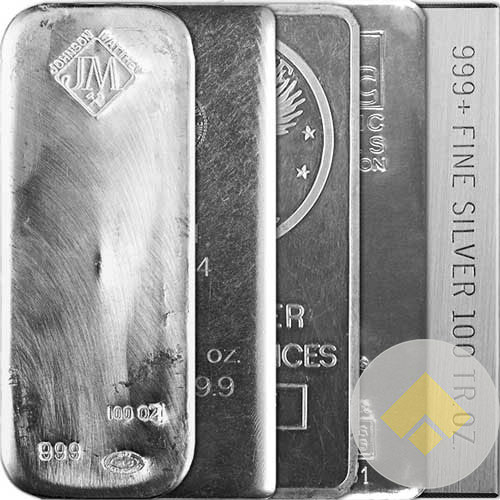

You can hold IRS eligible gold, silver, platinum, or palladium in your precious metal IRA. Is the http://www.grindleywilliamsportal.com/learn-exactly-how-we-made-best-silver-ira-companies-2023-last-month/ gold IRA company making false claims about the quality of its products. Gold coins minted by the Treasury Department that are 1 ounce, 0. It gives you a price match guarantee along with a buyback commitment. Entrust wires funds to your precious metals dealer. Each coin offers a full two British Pounds face value.

How does a 401k to gold IRA rollover work?

Digital Financing Task Force strives to keep its information accurate and up to date. In the precious metals market, supply and demand play a key role. As retirement approaches, it is natural to wonder what you will do with all of the money you have saved. Despite their promise to provide quick lending decisions, Kiavi borrowers report constant tardiness. With Gold Alliance, you can rest assured that your investments will be secure and your retirement savings will be well taken care of. You won’t pay any fees for life on a qualifying IRA. Investors can also roll over their existing 401k, or 403b accounts into precious metals IRAs. In addition, the IRS is now more strict. Silver IRAs are approved by the Internal Revenue Service and are a great way to diversify your retirement savings.

Great job of handling the process

We do not offer or render any legal, tax, accounting, investment advice or professional services. Next, Patriot waives all IRA fees if you have $100,000 in your account. A+ from the Better Business Bureau. American Hartford Gold Summary. Before you invest in gold, silver or platinum, however, here are some federal income tax issues to consider. We could do without some of the extra fees, but luckily, there are no management charges because the account is self directed. It was a great experience. A gold or silver IRA allows people to invest in platinum, silver, and gold using special tax advantaged accounts. You should pick a precious metals company willing to buy back anyone’s silver at the current market price. However, there are severe limitations of the platform that will give many traders pause before seriously considering eToro as their preferred trading platform. Over time, inflation will erode the purchasing power in your money.

Is a 401k to gold rollover right for me?

Mailing Address for BlueVault San Diego:7710 Hazard Center Drive E240San Diego, CA 92108. A gold IRA rollover can be a great way to diversify your portfolio and protect your wealth. If an investor fails to complete the transaction within that period, then the transaction will not count as a rollover but rather as an IRA withdrawal. The IRS requires that a custodian administer and track the assets in an IRA – a Precious Metals IRA is no different. They offer competent customer service both during and after installation. It is NOT a taxable event when you transfer your existing IRA to your new self directed account. The company’s Smart Tools Suite features the following resources.

GoldCo: Cons Gold and Silver IRA

Chat with an Online Specialist. Whether you are setting up a brand new IRA or transferring funds from an existing IRA or retirement plan, you may elect to pay all start up fees out of the assets in the IRA. Allegiance Gold can help you navigate regulatory requirements, avoid tax pitfalls, and diversify with physical precious metals to stabilize your retirement portfolio. Comparing the best gold IRA companies is an important decision for anyone looking to invest in gold. One of the ways to fund your account is through a silver IRA rollover. Privacy and security policies are consistent with applicable laws, Executive Orders, directives, policies,regulations, standards, and guidance. Their newly created “DeFi Securitized Mortgage Fund” provides accredited investors with access to their blockchain securitized loan portfolio. Gold products must be 99. Gold, silver, platinum, and palladium are a few of the precious metals that you can store in a precious metals IRA.

RC Bullion: Cons Best Gold IRA Companies

They also provide a secure storage facility, allowing customers to store their gold and other precious metals in a safe and secure environment. A: Yes, the IRS has specific requirements for the types of gold and silver that can be held in a gold and silver IRA. Quicken Loans in Detroit drastically sped up the lending process in 1985 it’s in the name by offering most of their application and review process online. When you open a gold IRA account with the company, you’ll get access to an account executive who will guide you through the process of setting up a gold IRA. Precious metal IRA accounts hold physical precious metals. When it comes to selecting the best silver IRA company, there are many options available in the market. With their commitment to customer satisfaction and competitive prices, Birch Gold is an excellent choice for those looking to invest in gold. The IRS also requires minimum distributions each year once you turn 70 1/2 or 72 if your birthday falls between certain dates. Second, it provides competitive prices for its gold purchases. So, go ahead and choose one that meets your needs. The gold you invest in must be 99. When it comes to finding the best gold IRA companies, you need to read the fine print. I have advised my friends to get their gold loans from IIFL.

Are There Any Legal Restrictions On Investing In A Precious Metal Ira?

Sam Rexford updates his list regularly. Before deciding to go all in on a Gold IRA, it is imperative to understand the primary benefits of having a Gold IRA account versus a regular IRA. However, when it comes to investing in gold, it is important to find a reliable broker or custodian to ensure the safety of one’s investments. The company has also made a name for itself with its investor education program. Lear Capital provides a safe and secure environment for investors to purchase and store physical gold, with knowledgeable and experienced staff who are dedicated to providing superior customer service. Our Multifamily Division purchases loans on apartment buildings from our network of Optigo® lenders, then bundles these loans into securities for investors – ensuring liquidity, stability and affordability in the market. 3 Commitments to Customers Transparency / Simplicity / Service. AHG also offers gold and silver bars of different sizes and weights, including a one ounce bar from sunshine mint and 10 ounce silver bars from several mints. This gold IRA rollovers guide takes into account the company’s reputation, customer service, fees, and more.

Advantage Gold: Cons Silver IRA

It has also served well during periods of high turmoil due to its perception as a “safe haven” asset. If we cannot add value, we’ll say so, and, when we are confident, we’ll share that too. Consider the experience, service, and costs associated with each option, as some may be better suited for you than others. Popular bars or proof coins include Canadian Maple Leaf, Credit Suisse – Pamp Suisse Bars of 0. We are entirely honoured by their trust in GoldCore. To get started, call 1 800 928 6468. This can streamline the process of setting up your silver IRA, as the dealer can coordinate directly with the chosen depository to ensure seamless transfers, storage, and management of your assets. Traditional IRARoth IRA401k403bTSPInherited or Beneficiary IRA. With a dedicated customer service team and a commitment to providing the best gold backed IRA options, Birch Gold stands out among its competitors. Invest in Your Future with Advantage Gold.

Pros

In most cases, you won’t face tax consequences for rolling over funds. When selecting a gold IRA provider, it’s important to look at several factors such as pricing structure and fees associated with investing in precious metals through them. Additionally, most distributions from a Precious Metals IRA account are exempt from federal and state taxes. Investors should also keep in mind that there may be fees associated with a Gold IRA rollover, such as account setup fees or transfer fees. Rocket Mortgage’s mortgage approval requirements are average compared to other mortgage lenders. Historically, gold has proven itself as a reliable investment by keeping up with inflation despite long periods of both underperformance and overperformance. Step 1: To receive a free informational guide, simply fill out the form with your email address, phone number, and other necessary information. We understand anyone can experience financial difficulty. Once an account is set up with Goldco, all precious metal transactions are facilitated while the IRS requirements are completed. In effect, they act like an insurance policy of sorts for a stock heavy portfolio. Some of the advantages include. If you keep your gold longer than a year, you only pay capital gains tax on the sale profit.

Diversification

This industry encompasses consumer photography, graphic arts, and radiography x rays, used in medicine and heavy machinery inspection. HBF Silver Plus, $227 per month. They’ve been in business for a decade and have earned a strong reputation for their commitment to customer satisfaction and first class storage options. “Noble Gold was very responsive to my questions and concerns. Ask our Retirement expert. Having a diverse investment portfolio is essential to hedge against inflation. Simply transfer funds from your existing IRA into a self directed IRA account, choose a depository who can provide storage, then buy the physical metals you want. Unlock the Benefits of Gold Alliance Now. Here is a deep dive. Learn more about our Wealth Planning services or contact your qualified tax advisor.

IRA Services For:

The company lists respect, education, and personal attention as its core customer service values. Protect Your Retirement with GoldCo: A Comprehensive Precious Metals Investment. My account rep was Ted Root and I am very happy with the service that Ted and his team provided me. My last two investments in the last 8 months were predicated on the advice of my Goldco rep. Additionally, physical silver can be held and stored outside of the traditional banking system, providing an added layer of security to an investor’s retirement savings. Overall, finding a reputable broker or custodian is essential when setting up a gold and silver backed IRA.

Discipline

There are some costs to be considered when starting a precious metals IRA. With a commitment to providing top notch customer service and a team of experts with decades of experience, Birch Gold Group is a reliable and trustworthy choice. However, with so many options available, it can be difficult to determine which companies are reputable and legitimate. Showing all 21 results. These are very much like traditional IRA’s and both offer tax benefits that allow individuals to grow their wealth while prepping for retirement. Midland works with the following depositories to store metals. Once your account is established, you can fund it with cash and begin purchasing IRA approved silver. When you work with this company, you’ll gain access to a team of dedicated professionals who can answer your questions at any time and provide guidance throughout the process. Central banks can print more paper money; they can’t produce more gold or silver.

RECOMMENDATIONS

Each customer gets a personal representative to provide assistance with self directed IRA setup and gold IRA rollovers. You should consult your own professional advisors for such advice. Scottsdale Bullion and Coin 14500 N. Therefore, it also makes them valuable since years will go by and they’ll still look the same. WHAT ARE YOUR CURRENT GOALS. Not all precious metal pieces may be kept in an IRA due to certain IRS regulations. This change was especially beneficial to IRA investors who prefer silver because they now can select silver bars, which carry much smaller premiums than Silver Eagle coins. The company’s professional gold IRA agents also educate investors who want information about precious metals before they decide to fund a silver IRA. Although certain types of physical gold, silver, platinum and palladium are legally permissible in an IRA, not all custodians offer this service. Additionally, Birch Gold will cover your first year’s fees if you transfer over $50,000.

Legal

MC 3196; Lender License No. Kitco cannot render any investment advice. To help you navigate this decision, we’ve ranked our top five silver IRA companies and outlined why each stands out. A silver IRA is also a Traditional IRA, a ROTH IRA, a SEP IRA, a SIMPLE IRA, or and Inherited IRA that is self directed by the account holder and owns allowable forms of physical silver coins or silver bars. To add gold and other precious metals to an IRA, you’ll need to open up a type of account called a self directed IRA, unless you already have one. Known as an alternative asset company Regal Assets was started by Tyler Gallagher and has been in business for over 10 years.

Take Us With You

Easily accessible information especially for the fees. Whereas regular IRA’s focus on stocks and other paper assets. Among the top contenders in the industry are Augusta Precious Metals, American Hartford Gold, Oxford Gold, Lear Capital, GoldCo, Noble Gold, Patriot Gold, Gold Alliance, Advantage Gold, Birch Gold, RC Bullion, and GoldBroker. Better makes it easy to see customized rates without signing up for an account first. Therefore, they may wonder why opening precious metals IRAs could be a more convenient alternative. The company relies on third party depositories to store your gold, and the depositories it uses are Brink’s Global Services USA, Inc. It’s important to remember that every bar and coin carries a different buy/sell spread and that the spread can change over time due to supply and demand conditions. Any person 18 years or older who has a UK bank account and can pass the verification checks. Discover the Benefits of Investing in American Hartford Gold Today. So we made sure that the fees are reasonable and comparable. In line with our mission to protect and grow your wealth, we facilitate the ownership of precious metals in the safest ways possible utilising the most secure vaults in the US and Canada. Augusta warrants that all of its metals are 99. B500605 and Exempt Mortgage Loan Servicer Registration No. The most common gold bullion bars are the 1 oz bars, the 10 oz bars and kilo bars 32.